Document analysis powered by AI

Fraudfinder is your superhuman risk analyst. Ask our AI agent to detect document fraud, extract data, and underwrite deals instantly.

We’re trusted by industry-leading companies

A new era for Risk & Operations teams

Document fraud is evolving- our AI Agent evolves faster. Detect, prevent, and eliminate risk in real-time.

Fraudsters manipulate documents - our AI Agent catches them. Identify forgeries commonly missed by humans.

The Fraudfinder AI Agent extracts & standardises key personal and financial data from various document types.

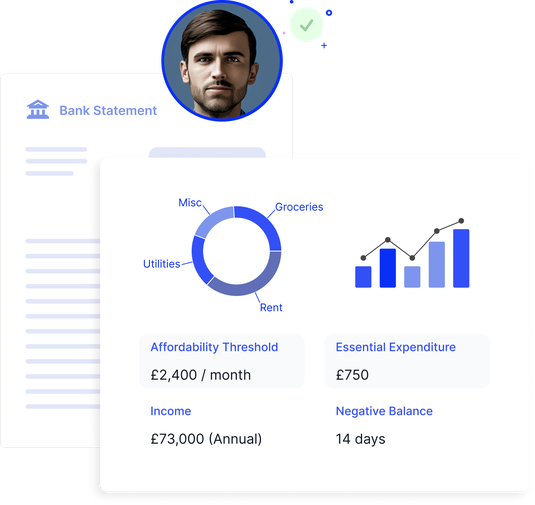

Manual risk assessments slow you down. Fraudfinder AI accurately analyses bank statements and affordability metrics.

Say yes to the right customers, faster. Our AI Agent reduces false declines while blocking fraudulent applications.

Supercharge your Risk & Ops teams with AI

Equip your risk teams with document insights they didn't know existed. Uncover fraud, approve more customers with confidence, anywhere.

Instantly flag document fraud at scale. Tampered addresses; deleted transactions; template farm formats.

Verify the authenticity of supporting financial documents in seconds, preventing fraud before it enters your pipeline.

Quickly extract structured data points from financial documents. Retrieve & normalise Personal, account, and financial information.

Application risk solutions across markets

Fight fraud, verify data and measure risk to approve more quality customer applications...

What our clients say

Fraud Finder has proven to be a very useful tool for our fraud prevention team. It provides a robust evidence trail for the records & is also a useful screening tool to pick out the documents submitted in support of applications which need further scrutiny. The product has prevented several fraudulent applications since we introduced it into the business and it is now a permanent addition to our checks

Financial qualification success stories

advanced risk assessment technology

Powerful tech. Substantial results.

"Fraud Finder has quickly become an essential part of our fundamental checks at Halo. The ability to quickly verify fraud within our bank statements has significantly benefited our turnaround time and our own initial checks with data-backed findings."

Abigail Withers, Halo Corporate Finance

As seen in

Industry recognised technology

In 2023, Sifted recognised Fraud Finder as an "early-stage startup to watch in financial crime and compliance" following the new release of our document fraud detection tool, Fraud Finder.

Our technology has also been shortlisted for The Negotiator's 'Technology Supplier of the Year' award, The Negotiator's 'Products & Services Supplier of the Year' award, GP Bullhound's 'Tech for Good' award, EG Tech's 'Innovative Product' award & UKPA 'Social Impact' award.

"This tool is very intuitive and quick. This is so exciting, it's a game-changer"

Piero Bassu, General Manager, RVU

An Everest Group Leading Financial Crime and Compliance Technology Provider

We’re proud to announce that Fraudfinder has been named one of the Everest Group Leading 50™ Financial Crime and Compliance (FCC) Technology Providers for 2025. This prestigious global ranking recognises the top providers driving innovation in the fight against financial crime.

Companies were selected through a rigorous evaluation across four key criteria: scale and growth momentum, value-chain coverage, innovation and investment, and client/geographic reach. Our inclusion highlights Fraudfinder’s commitment to delivering cutting-edge, AI-powered solutions that help lenders and brokers stay ahead of evolving fraud risks and regulatory demands.

Step into the future of customer risk assessment...

We'll provide a short no-obligation demo of each element of our fraud tech, book below: