The UK rental market has witnessed a massive surge in the rise in the need for guarantors for people renting property up and down the country. The initial surge came after the pandemic when a multitude of working professionals flocked back to cities and urban areas after opting to spend the lockdowns in more rural parts of the UK.

If you're reading this and are unsure what a guarantor actually is, a guarantor is a third party liable to pay a tenant's rent if they default on their payments during the rental agreement term.

Guarantors may be parents, close relatives, or company guarantors like us. When the economy, and life as we knew it, came to a standstill in 2020, landlords decided to make their due diligence processes more stringent with a widespread fear that people placed on furlough or fired would not be able to pay their rent regularly.

Not to mention, there are certain criteria that are required of guarantors in this country. Here are a few pre-requisites a guarantor in the UK must match:

they must be over the age of 21

they must hold a separate bank account from the tenant

they are typically required to have a good credit history

they must reside in the UK

Between this list of requirements and the rise in due diligence, more and more people have been turning to guarantor companies like Homeppl Guarantid to successfully secure a rental property.

Why has there been a demand for guarantors?

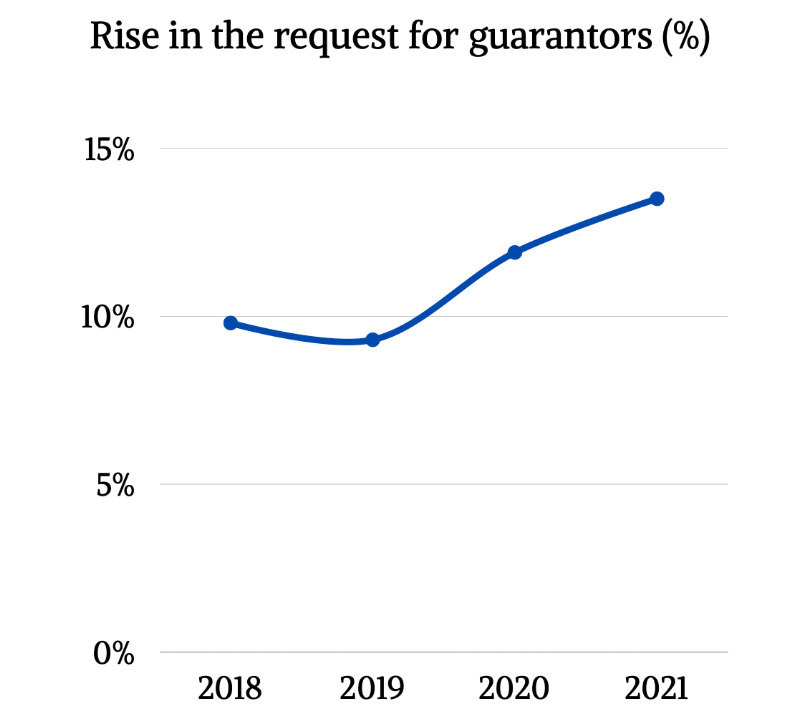

Property Reporter published data conveying that after the breakout of Covid-19, the demand for guarantors across all types of tenants and properties surged in the UK at a recorded increase of 36% since the end of 2019.

Financial instability struck fear into both lenders and landlords, as it often does. Additionally, it must be remembered that many landlords became reliant on rent as a sole source of income during this period.

In February, Property Industry Eye, alongside Goodlord, published data on a study of 730,000 employed/self-employed tenants (non-students) who moved into rental properties between 2018 and December 2021.

In this timeframe, the request for guarantors rose from 9.8% to 13.5%... an overall spike of 36%.

Fresh data for December 2021-July 2022

Homeppl have conducted primary research showing that this striking trend did not stop in December 2021.

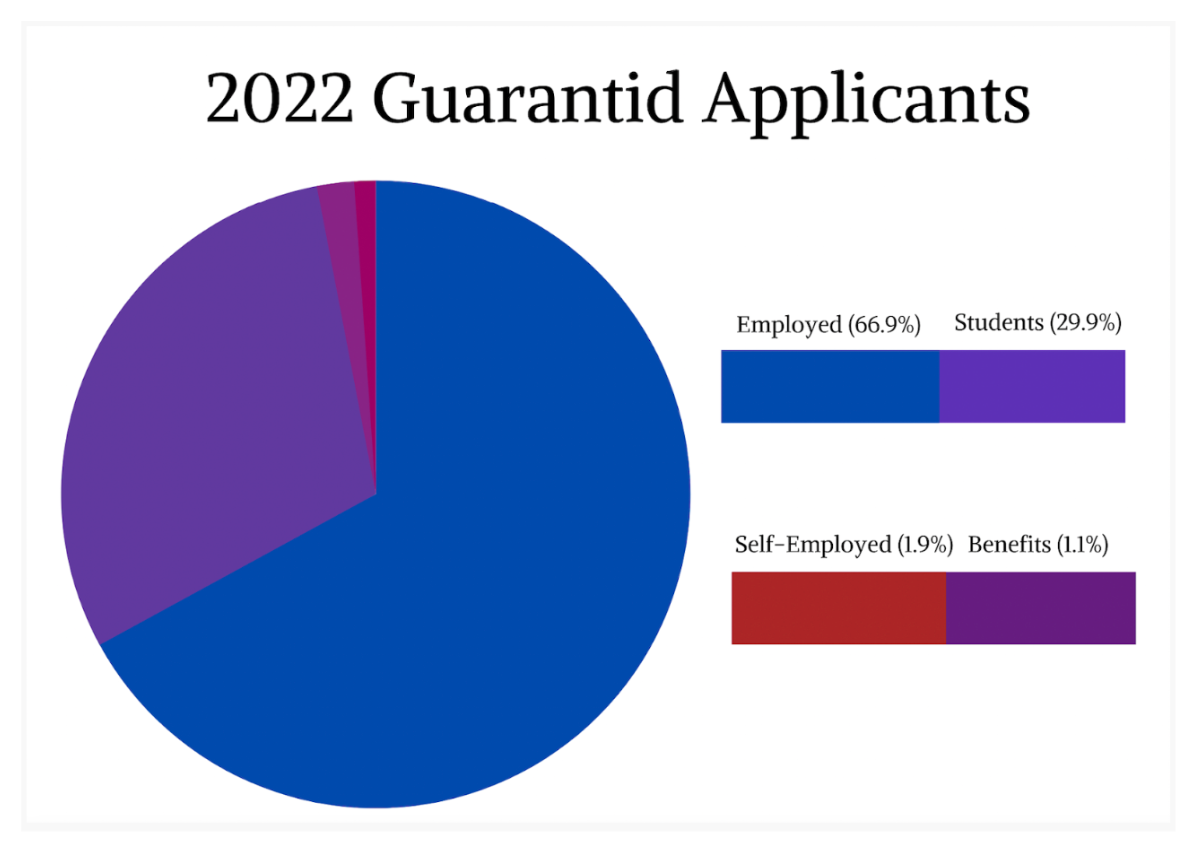

On the contrary, Homeppl received over 22,000 applications in 2021 and have received 16,000 applications for rent guarantors between January & July 2022. Only 3,115 were student applicants.

Applications also significantly increased across all income status applicants. 6,955 came from those who were employed, 207 were self-employed, 3,115 were students, and 116 were on benefits.

What does this data suggest? It shows us that landlords and lenders have become no less uncertain since the last study and the conclusion of the pandemic period in the United Kingdom. It shows that the cause of uncertainty has shifted but not the uncertainty itself.

With the looming recession in the UK, rising rent prices, rising interest rates, the cost of food and a fear of another dramatic gas hike in the fall... a direct correlation for the requirement for guarantors is evident.

Are the demands made by landlords out of control?

There also seems to be an increase in the number of landlords asking for full rent payments upfront, causing immense pressure upon tenants. Many tenants just cannot afford the demands of substantial upfront payments and are therefore left at huge risk of not being able to rent a home.

The BBC reported on a case study in which a Welsh tenant was asked to pay his first 6 months of rent upfront, approximately £5,000. Which he did. After those 6 months were up, the landlord then asked to have the remaining 6 months upfront as well despite having proved he can afford the monthly rent payments.

Prospective tenants, such as those who come from abroad or low-income families, are commonly faced with the immense pressure of having to find somehow the money to pay multiple months of rent in advance, even when they have a guarantor. Although the government has attempted to place some limits on landlords to minimise what they can demand, such as caps on deposits, there is still no limit upon how many months of rent they can require upfront. Nearly 22% of cases that asked for more than one month asked for six months of rent upfront.

To learn more about Homeppl Guarantid's rent guarantor service, click here.