Welcome to the first edition of our monthly Fraudfinder Risk Index, a data-driven report revealing which banks are most frequently associated with fraudulent documentation.

This report will evolve each month, bringing fresh data insights to our community, so you’re always equipped to understand and combat the latest trends in document manipulation.

In today’s world of instant lending, embedded finance, and digital onboarding, fraudsters move faster and smarter than ever. Whether targeting lenders, brokers, BNPL platforms, or online gambling sites, their tactics are evolving - and so must our defences.

At Fraudfinder, we analyse thousands and thousands of new documents every month using advanced AI to detect signs of tampering, manipulation, or synthetic identity usage. This blog surfaces the top insights we’ve uncovered in June 2025.

This month’s top 5 banks for high-risk documents

Based on all documents flagged as high risk in June (across all sectors), these are the banks that appeared most frequently:

Allied Irish Banks – 15.09%

HSBC – 9.55%

Lloyds Bank – 8.86%

Bank of Ireland – 8.35%

Barclays Bank – 6.10%

These figures are not based on overall document volume, but rather the concentration of flagged risk among documents that our platform determined to be manipulated, altered, or otherwise suspicious.

Why are these banks targeted?

These numbers don't suggest wrongdoing by the banks themselves, rather, they reflect how often fraudsters attempt to impersonate or forge documentation from these institutions.

Why?

They are large and well-known, making forged statements seem credible

Their brand trust is often exploited in loan or affordability applications

Fraudsters often use real bank names to bypass automated checks or low-touch onboarding

Additionally, many of these banks regularly change their statement layouts - adjusting fonts, branding, page structures, T&Cs and data formatting. While this may improve UX or design, as well as provide a recourse against fraudulent document matching, it introduces a challenge for fraud detection systems that rely on static templates or fixed rules.

At Fraudfinder, our AI-powered document clustering detects and adapts to layout changes. Instead of relying on brittle templates, our models group and learn from evolving formats as they are submitted, detecting changes in the document’s meta data. This allows us to flag manipulated documents even when banks release new statement versions.

This flexibility is key to staying ahead of modern document fraud, where the forgery often looks perfect, but the underlying structure doesn’t hold up under deeper analysis.

June fraud playbook: tactics we detected

Our models flagged thousands of documents using a mix of basic and advanced manipulation techniques. Here are the most common red flags our system detected:

Edited opening balances and transaction histories to inflate affordability

Fake PDF metadata used to spoof document age

Synthetic profiles created with real account details but seemingly fake transaction descriptions

Templated documents reused across multiple applications

These patterns were most frequently linked to documents referencing AIB, HSBC, and Lloyds.

Real-world case examples

Here’s a glimpse into three real high-risk document types from June:

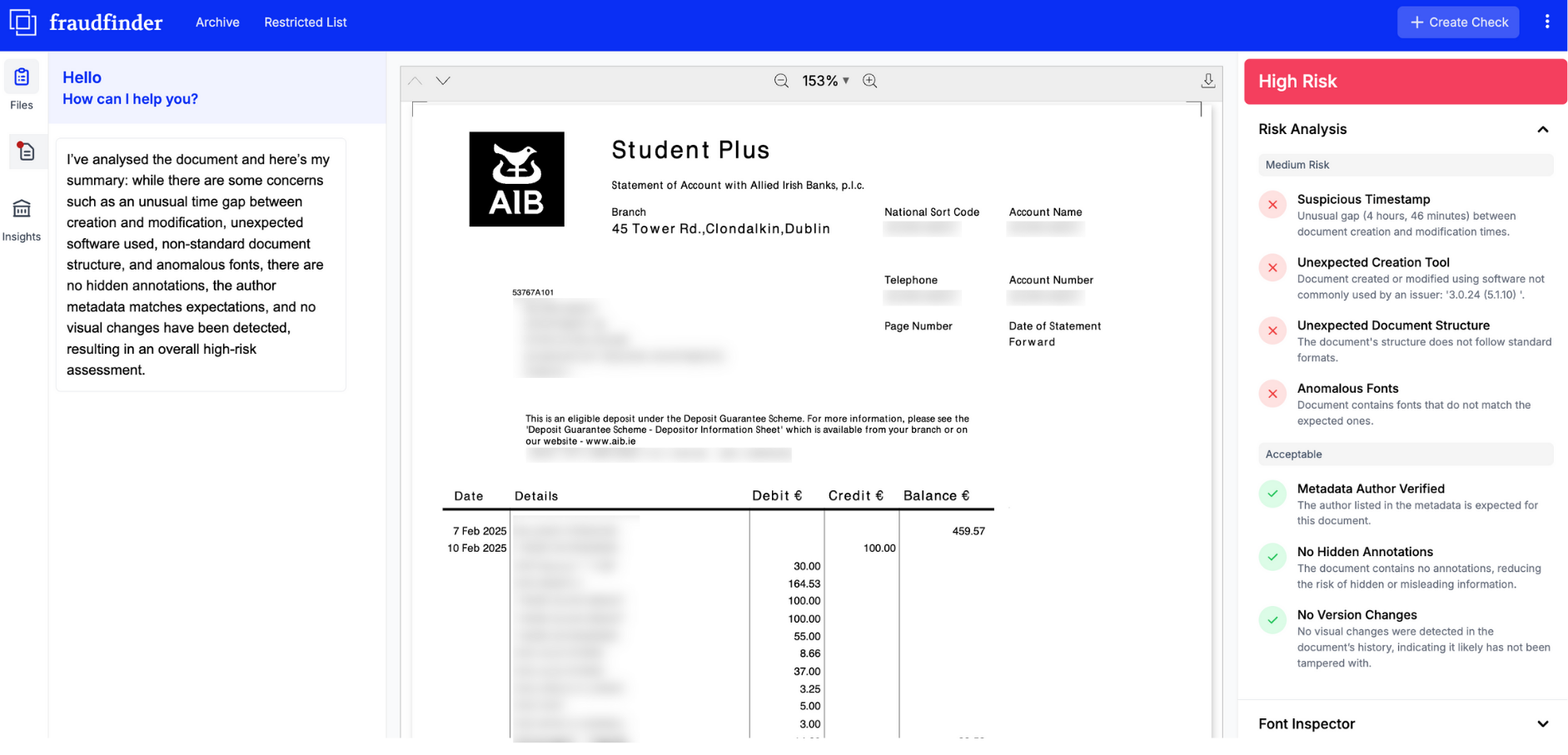

1. Allied Irish Banks (15.09%)

Below is an example of a manipulated AIB document. Within just four seconds of analysis, we identified an anomalous font used in the address section, one not consistent with official documents from the well-known Irish bank. This suggests the applicant may have been attempting to evade a credit reference check.

Further analysis revealed that the document was edited more than four hours after it was originally generated on AIB’s online banking platform. These manipulations altered the document’s expected structure, and the editing software used did not match the production systems typically employed by the bank.

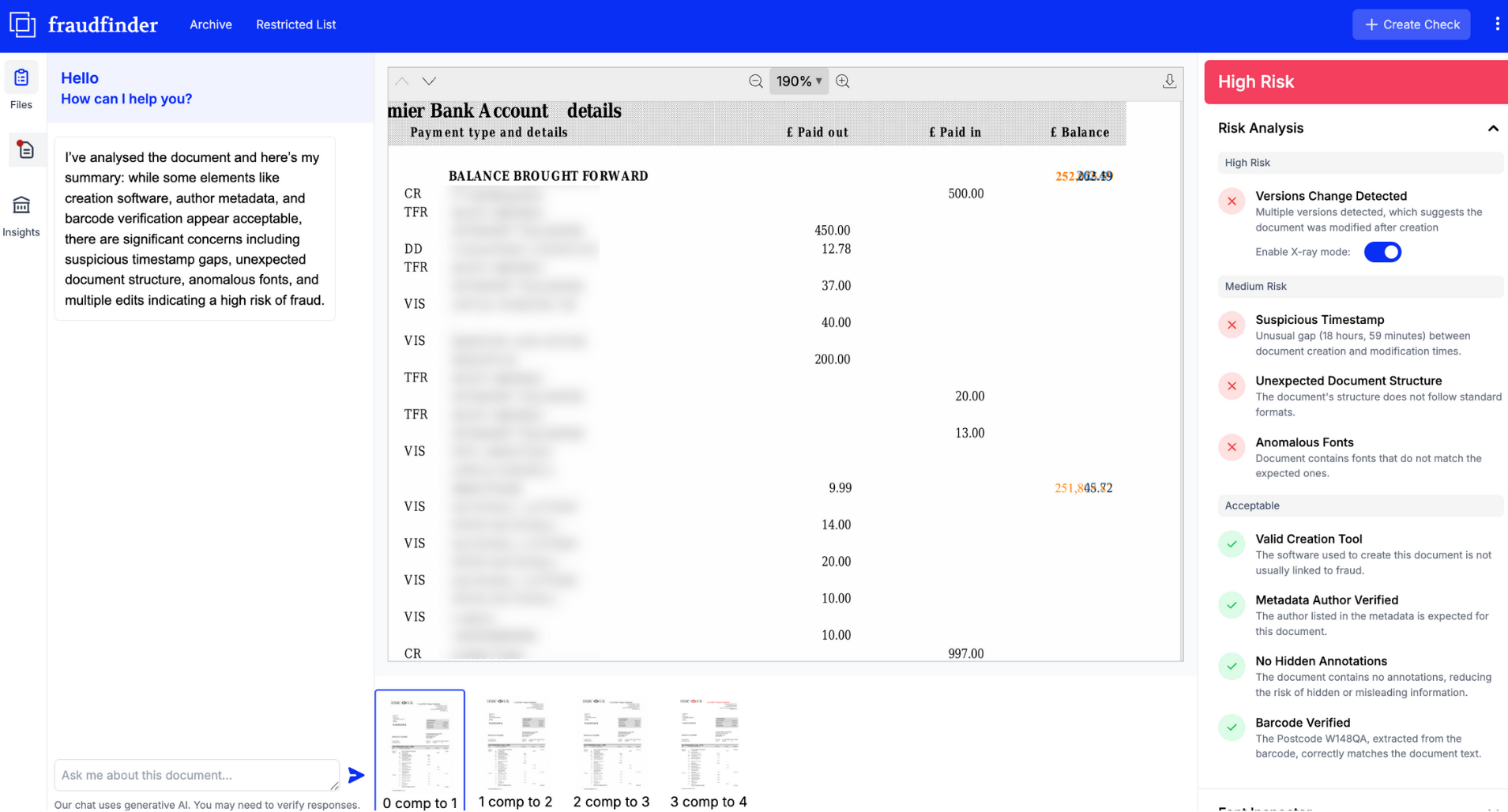

2. HSBC (9.55%)

In this statement, we detected at least four prior versions of the file before the one ultimately submitted as part of the finance application.

One standout feature of Fraudfinder is its ability to track changes made after a document’s creation. Any data added post-generation is highlighted in orange. In this case, the fraudster inserted a suspicious £252,000 into their bank balance, multiple times throughout the statement, significantly inflating their financial position and increasing the risk for our client had it gone unnoticed.

Additionally, the fraudster failed to replicate HSBC’s locked fonts, and our system confirmed that the document was edited 18 hours and 59 minutes after it was originally downloaded from online banking.

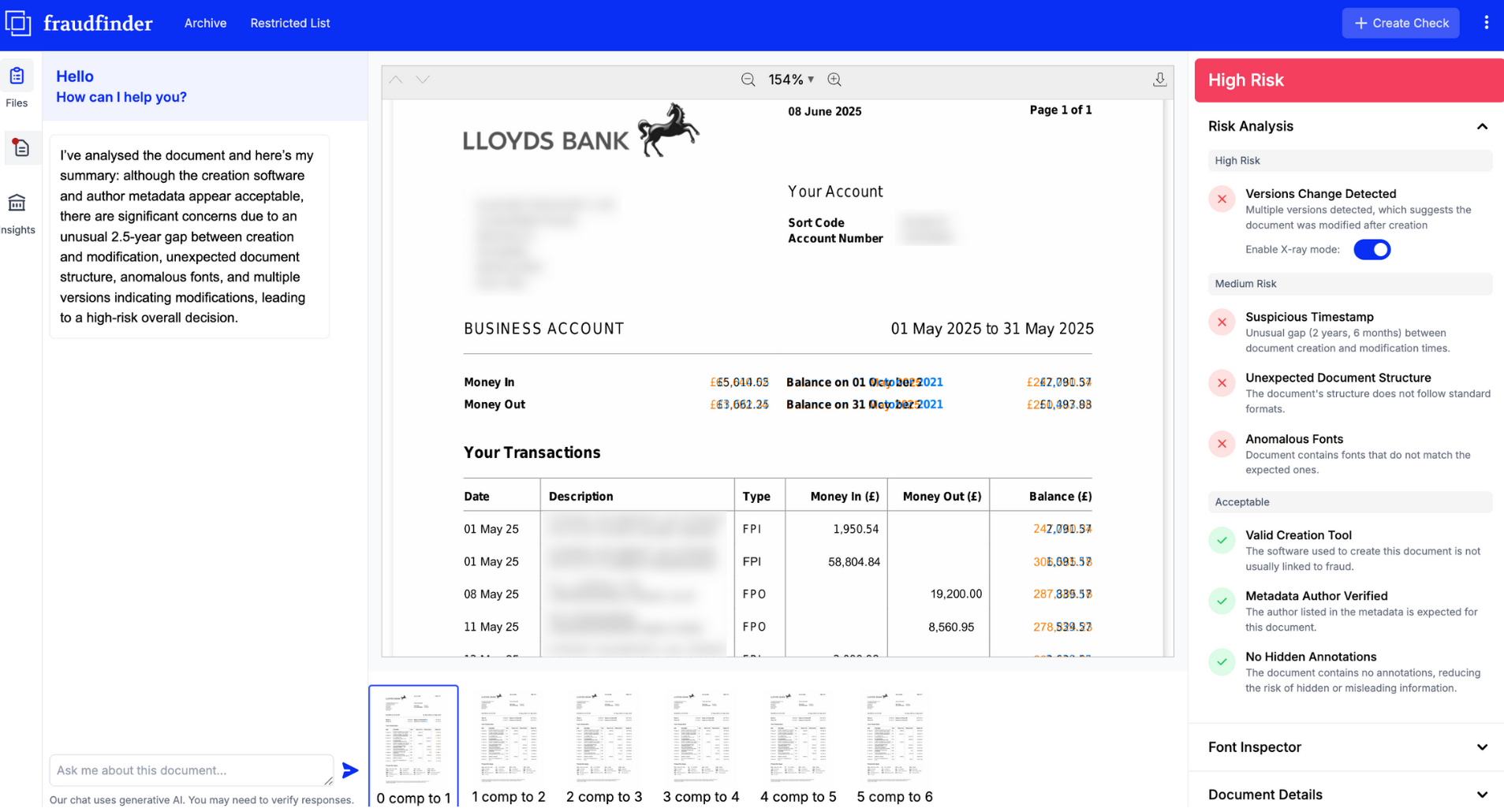

3. Lloyds Bank (8.86%)

In our final example of the month, we identified another significant sum, well into the hundreds of thousands of pounds, fraudulently added to a bank balance where no such funds actually existed. The business owner also appears to have updated figures and dates on a statement that originally dates back to 2021. Our timestamp analysis confirms that the document is several years old, despite being presented as current.

How Fraudfinder catches what humans miss

Fraud is no longer just about spelling errors or missing logos. In 2025, fraudsters are using AI to create high-fidelity forgeries that can easily pass human review. That’s where we come in.

Fraudfinder combines multiple layers of analysis to detect even the most sophisticated document fraud, including:

Image Forensics – to uncover tampering in scanned images and PDF files, identifying signs of pixel-level manipulation.

AI Document Detection – to flag documents that have been artificially generated using AI tools for proof-of-address or proof-of-funds purposes.

Metadata Analysis – to trace document history, including timestamps, authorship, and software used, revealing inconsistencies that indicate fraud.

Cross-Document Consistency Checks – to compare data across multiple submitted documents, highlighting mismatches in formatting, naming conventions, or timeline inconsistencies.

Embedded Object Detection – to identify hidden layers, overlays, or edited elements embedded within PDFs that are invisible to the naked eye.

This multi-layered approach allows us to stop high-risk documents before they ever reach underwriters, brokers, or platforms.

Why this matters. And what’s next?

This is more than a leaderboard. It’s a window into where document fraud is happening, and how.

As the financial ecosystem continues to digitise, fraud risks will increase in both volume and sophistication. Our mission is to bring transparency and protection to that space, one insight at a time.

“Fraudsters treat documents like software, they test, iterate, and deploy until something works. Our job is to stop that before it starts.” – Alexander Siedes, CEO of Fraudfinder

This monthly series will serve as an ongoing benchmark for the industry. Over time, we’ll provide trendlines, alerts on emerging tactics, and even bank-specific improvement insights to help raise the bar for fraud prevention across sectors.