AI document analysis for Source of Funds checks

Uncover fake or hidden transactions; analyse source of income and wealth with automation.

We’re trusted by industry-leading companies

According to CIFAS, approximately 16% of UK adults have misrepresented financial information on mortgage applications.

In 2023, UK business and consumers suffered losses exceeding £1.17 billion due to various fraudulent activities.

In-house risk teams spend up to 100 minutes assessing one consumer application and are prone to making human mistakes.

Automate and strengthen AML efforts with AI document fraud detection

Unmask illicit funds and investigate origins of deposits and payments with financial document validation.

Instantly uncover instances where a salary has been inflated, an income source faked, or an address changed across document types.

Check that hundreds of transactions on a bank statement reconcile with the statement end balance in minutes.

Transform bank statement data from PDFs into CSV or JSON. Use that data to check for common flags in transaction descriptions.

Ensure that an applicant’s personal data is consistent across a range of supporting financial documentation.

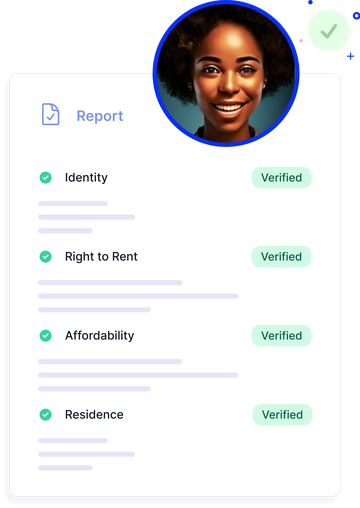

risk and affordability

Compliance checks

“Fraudfinder has prevented several fraudulent applications since we introduced it into the business and it is now a permanent addition to our checks.”

Simon Williams, Head of Compliance, Portman Finance Group

Sectors we serve

Protect against the growing risk of fraud in credit, business loan & vehicle finance applications.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Talk to us about simplifying your compliance processes

We'll provide a short no-obligation demo of each element of our fraud tech, book below: