Match application & document data

Replace tedious matching of personal information found on applications and their supporting documents.

We’re trusted by industry-leading companies

To run a risk report and determine the legitimacy of the financial document whilst identifying areas of manipulation.

It may take a human hours to locate and accurately extract customer information. Fraudfinder is trained to extract instantly.

Is the time it takes to train our technology to learn the structural and metadata makeup of a legitimate document issuer.

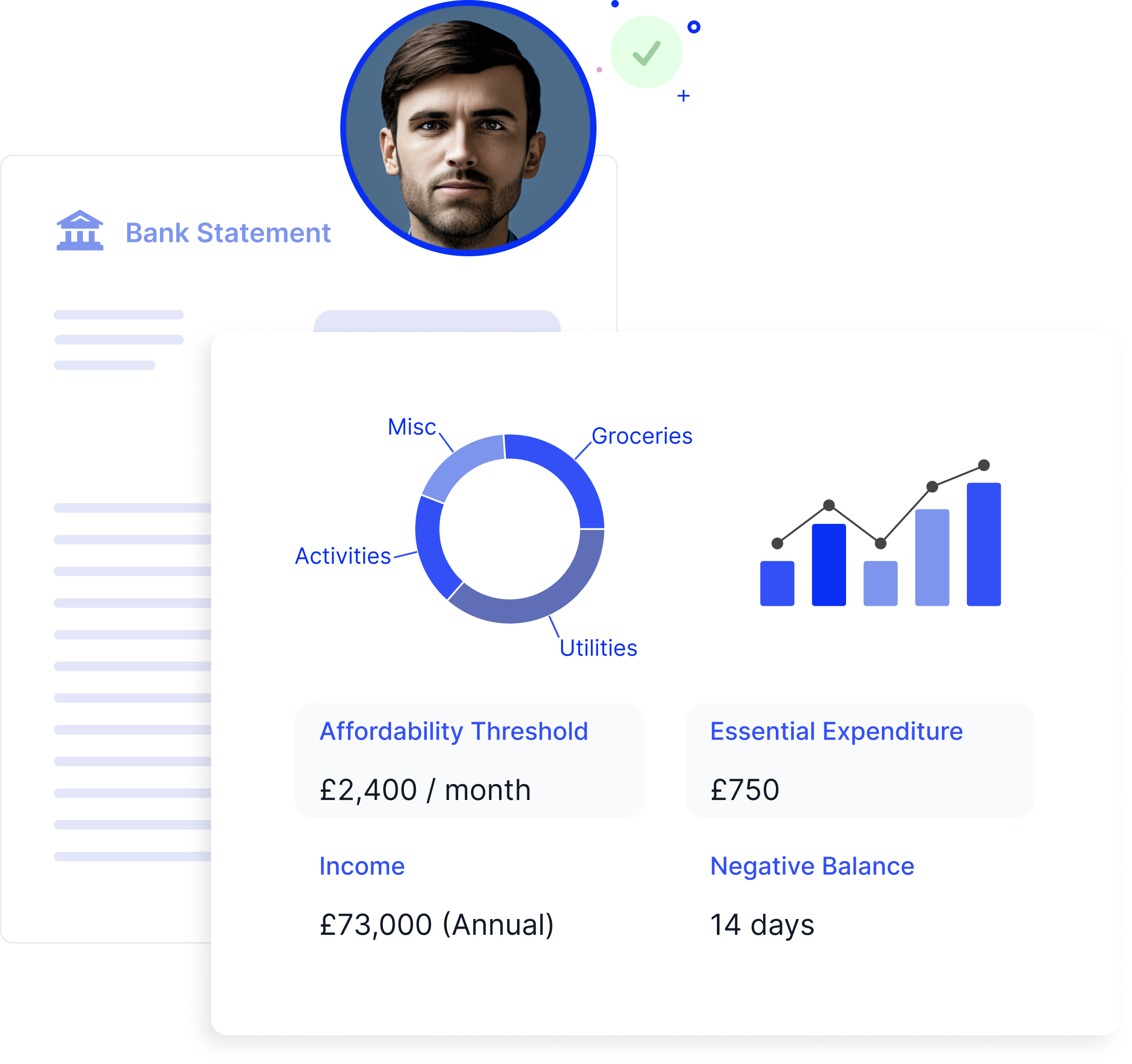

AI that reads bank statements like a team of underwriters

Uncover risk, reduce simple human error, and ensure data between your CRM and your application documents are matched — in seconds, not hours.

We turn any bank statement into unified code and create a report packed with useful affordability analysis.

Extracting financial and personal information at scale can augment efforts to identify patterns of customer behaviour; legitimate or risky.

Forget checking transactions on 500-page documents, have your humans build efficiencies in other areas of the review process.

Cross-examine income sources, banking activity with important affordability information declared in an application.

risk and affordability

AI document extraction

“The emergence of AI technologies has transformed the landscape by enabling the creation of fraudulent documents that closely resemble authentic ones. Machine Learning automation is no longer a nice-to-have, but an essential.”

Justin Amos, Managing Director, Millbrook Business Finance

Sectors we serve

Protect against the growing risk of fraud in consumer, business loan & vehicle finance applications.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Simplify your risk and affordability assessments

We'll provide a short no-obligation demo of each element of our fraud tech, book below: