Verify document structure instantly

Use AI and data to verify if applicant documents meet required formats and expectations.

We’re trusted by industry-leading companies

Every data point collected and learnt across the majority of traditional & challenger banks as well as EMIs.

Our AI can verify the structure of almost all the utility provider documents across the UK and Ireland within seconds.

Collect, cluster, and learn legitimate document structures from any provider worldwide, ensuring easy verification on any document, anywhere.

Automate global deep-layered document analysis

Your human risk team can’t decode Italian payslips or Chinese bank statements. Our AI risk analyst can.

Humans just can’t learn the structural make up of 000s of global documents. Our AI can. Don’t let fraud slip through the net.

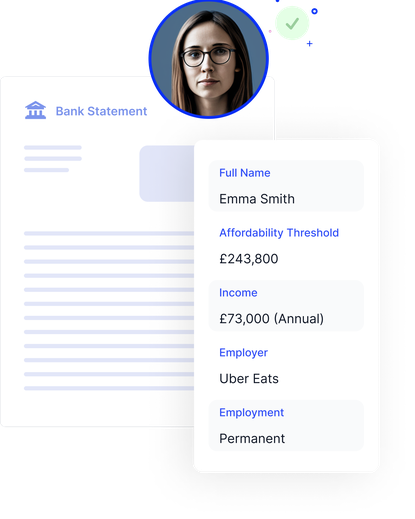

Extract and validate the account number, sort code and IBAN is to ensure that bank account belongs to the right applicant.

Documents are so much more than the eye can see. Fraudfinder analyses metadata against known templates and data designs.

Automatically flag instances where data extracted from bank statements doesn’t match the information on customer applications.

Fraud and data

Information check

“Fraud Finder has been great to confirm our intuition was correct. It also gives us evidence of the fraudulent activity”

Kathy Hawes, Director, Letref

Sectors we serve

Protect against the growing risk of fraud in credit applications during a global cost of living crisis.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Boost operational efficiency with automated document checks

We'll provide a short no-obligation demo of each element of our fraud tech, book below: