Case Study: BetGoodwin

How BetGoodwin leverages AI to detect and prevent document fraud, safeguarding their gaming platform and protecting players.

We’re trusted by industry-leading companies

Fraudfinder identifies over 10 fraudulent accounts a month for BetGoodwin.

Bonus fraud and multi-account creation prevention in place.

of suspicious documents submitted confirmed high risk.

Fraudfinder has become in invaluable tool in accessing confidential client documents. It helps us to analyse the legitimacy of documents we receive and to flag fraudulent ones. Often the inconsistencies Fraudfinder helps us to identify would simply not be spotted by the human eye alone.

Raising the stakes: How BetGoodwin is winning the fight against document fraud in gambling

Large deposit AML checks, detecting fraudulent address changes, and reducing multi-account creation: How Fraudfinder helps BetGoodwin find suspicious accounts and satisfy KYC checks

BetGoodwin has its roots as a telephone betting service that grew to be one of the biggest of its kind in the UK. They take great pride in offering a personable and efficient service to its many customers. Their unique up-to-£100 horse racing free bet refunds are the talk of the industry. In 2022, they officially launched BetGoodwin, a new and exciting online sportsbook that's available via app, mobile and PC.

The long-awaited BetGoodwin Casino landed in December 2023 and was an immediate success with customers benefiting from the huge range of slots games and live casino offerings. They are growing exponentially as an online gaming powerhouse.

In the online gaming industry, document fraud, such as identity theft and bonus abuse, has become a major concern, with industry fraud rates increasing by 64% from 2022 to 2024, as fraudsters target new and multiple account registrations and promotional offers. Online gaming platforms are prime targets for fraudsters looking to launder money, turning illicit funds into seemingly legitimate gambling winnings. Meanwhile, opportunistic players seek loopholes in live-action games, sometimes fabricating fake identities to exploit vulnerabilities.

While many gaming companies use automation to detect fake ID documents, financial documents, such as falsified bank statements and utility bills, are still routinely subject to manual reviews only. Manual reviews are so often at the mercy of human error. Fraudfinder empowers BetGoodwin to instantly flag players who manipulate their proof of address to bypass self-exclusion measures, helping maintain their duty of care. It also strengthens BetGoodwin’s merchant payout process, ensuring funds reach the correct bank accounts while minimising account fraud risks.

Additionally, Fraud Finder detects players attempting to conceal gambling transactions on their statements. Any gambler reaching a certain deposit threshold undergoes document verification, often uncovering fraudsters who fabricate financial records for nefarious purposes.

Our analysis found that 12.5% of all PDF documents submitted to Fraudfinder by BetGoodwin were high-risk. Below, we highlight three real cases where Fraud Finder successfully detected fraud, each involving a different yet commonly requested document type. These examples showcase the essential safeguards that all responsible gaming providers should use to verify player identities and maintain platform integrity.

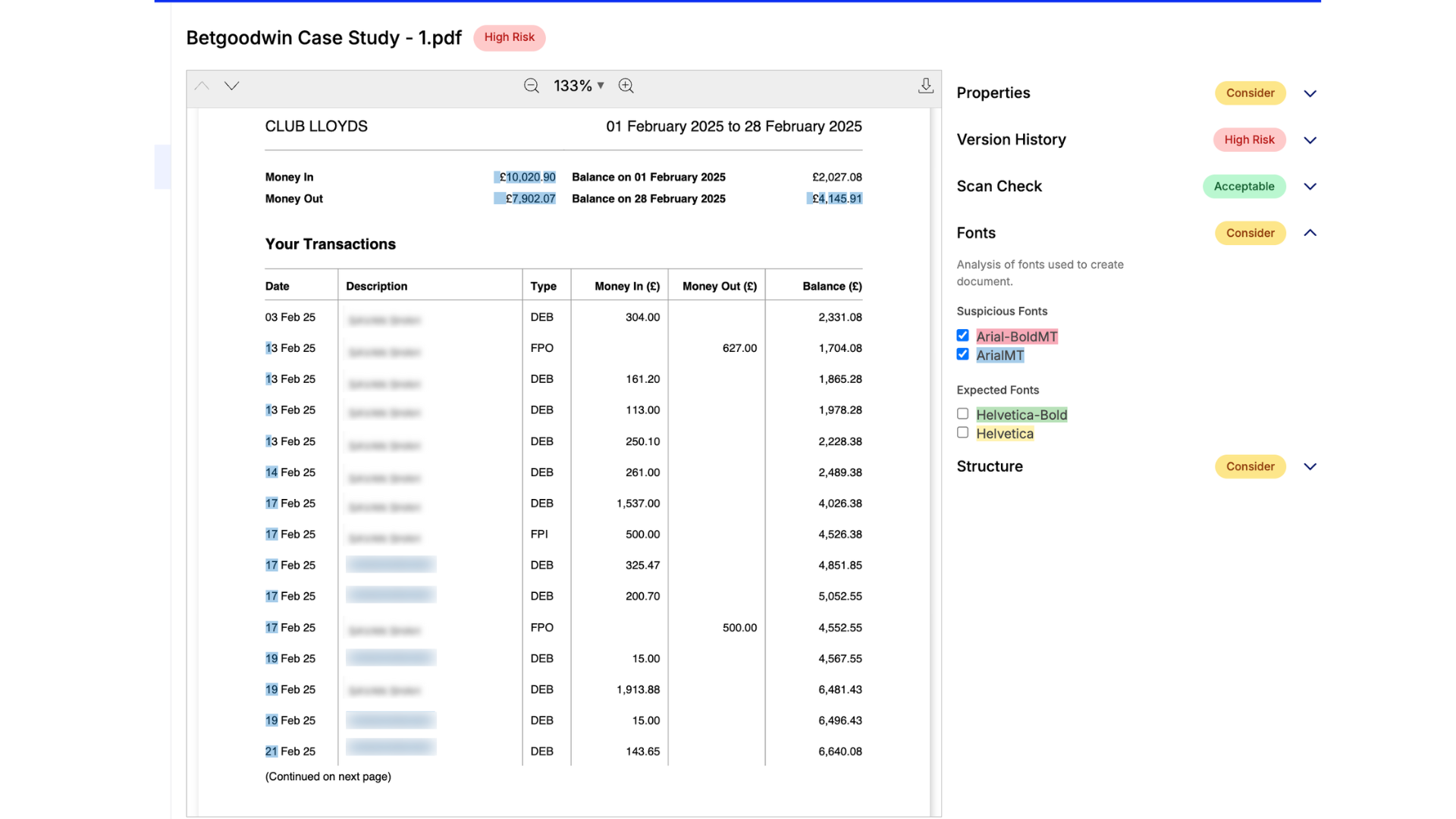

Example 1: Suspicious fonts and manipulated balances on a Lloyds personal account.

In the example above, Fraud Finder flagged multiple high-risk indicators. First, the document was edited three days after its creation, a red flag for potential tampering. Next, its structural layout didn’t align with genuine Lloyds Bank statements. However, the most conclusive evidence came from our font analysis test, which detected two suspicious fonts not typically found in Lloyds statements. These discrepancies appeared in transaction details, the overall balance, and several date fields - suggesting the account holder manipulated their statement to conceal true transactions and alter the timeline.

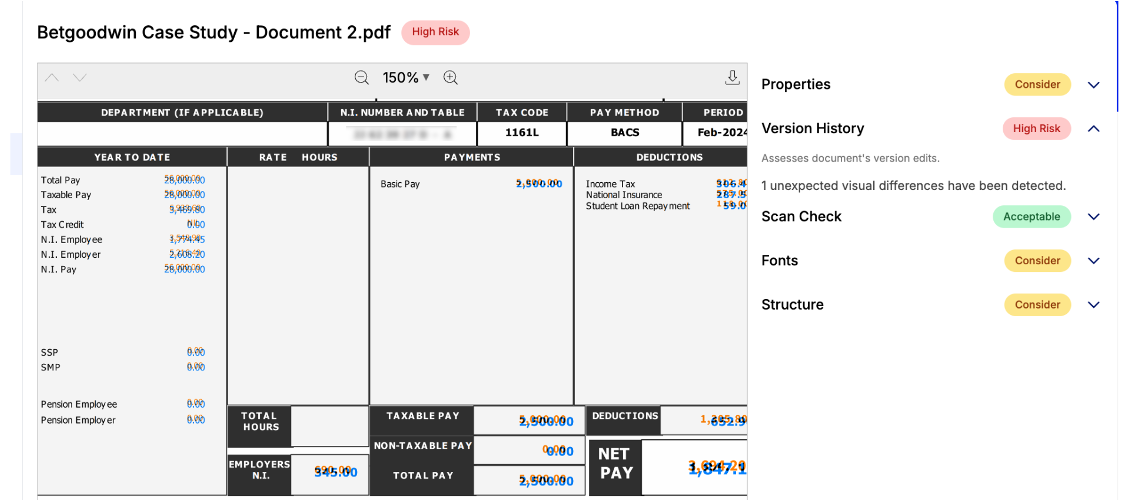

The second example comes in the form of a fraudulent payslip. The applicant is asked to provide a proof of income, perhaps to conduct a routine AML check triggered by a large deposit threshold being reached.

The payslip was edited a month after it was issued. However, Fraudfinder also uncovered several deleted data points proving that the amount paid from employment has been drastically increased. In this example, blue represents original data deleted by the account holder. Orange represents the fake information that replaced it. Net pay, taxable pay, total pay and basic pay have all been tripled in value. None of the final submitted financial information was accurate.

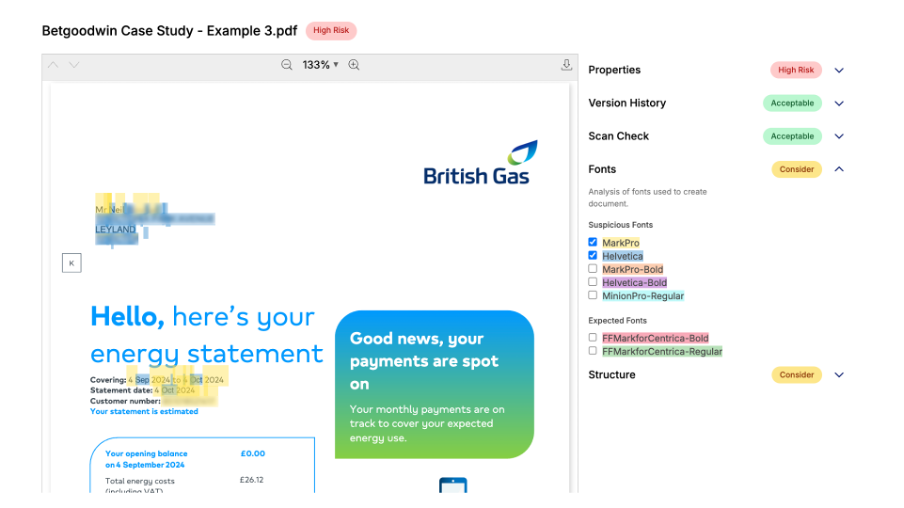

The third example is a British Gas utility bill. This account holder may have already self-excluded themselves from gambling with BetGoodwin and many other online gaming websites. You can see that the address and name on this utility bill have been manipulated.

The yellow and blue font highlights in this document are marked suspicious, as we typically don’t find them in British Gas bills. These font inconsistencies appear around the account holder’s name, address, and statement date - areas that should remain uniform. Such irregularities suggest the account holder may have borrowed a friend’s proof of address (POA) to open a new account. Thanks to BetGoodwin’s commitment to player protection, this fraudulent attempt was identified and blocked.

Manual reviews of financial documents in the gambling industry are no longer fit for purpose. As fraud evolves, gaming providers must leverage advanced technology to stay ahead. Fraudfinder offers a free trial, enabling operators to enhance player protection, strengthen compliance, and automate document fraud detection - just as BetGoodwin, Hippodrome Casino, and others have.

Click here to book a demo and a free trial or email harry.foster@fraudfinderai.com to get started.

About

Fraud and risk in Gambling & Gaming

Features applicable:

Bank statement, payslip, utility bill, tax document fraud detection

AI Image Detection

Previous versions fraud test

Barcode decoding

Font analysis

Structure, layering and metadata tests

See Fraudfinder in action

Instant fraud detection with the click of a button...

Looking to automate your fraud risk process?

Book a demo today...

We'll provide a short no-obligation demo of each element of our fraud tech, book below: