Flexible pricing for SMEs

Access AI document fraud analysis technology on terms that work for your volume, budget, and growth stage.

We’re trusted by industry-leading companies

Start with monthly, annual, or credit bundles you can use ad hoc, just for when you need them with no commitment.

Don’t pay £000s per month when you’re only checking 50 documents a month. Avoid high flat fees with Fraudfinder.

Tier 1 banks with multi-million-pound budgets can afford anti-document fraud tech. Well, now, so can startups and SMBs.

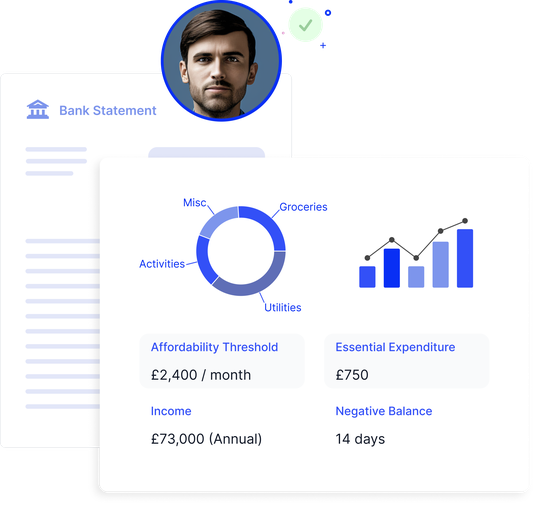

Intelligent document analysis with Fraud Finder

Our document analysis tool detects application fraud via a secure portal or an easy-to-integrate API.

Fraud technology shouldn’t be gate-kept behind rigid packages and high entry costs. Whether you run 50 or 50,000 checks a month, Fraudfinder gives you access to document fraud tests trusted by large lenders.

SMEs, lean ops teams, and startups often want robust checks without long-term lock-ins. That’s why we offer flexible options: monthly, annually, or buy check bundles to use as you go. No overpaying. No wasted volume. Instant access to risk data.

From micro-lenders and letting agents to fintech platforms and affordability tools - small teams across industries use Fraudfinder to level up their checks, without draining resources.

Our contracts are clean. Our onboarding is fast. And our support is UK-based and human. You get the document fraud detection you need - minus the headaches and heavy terms.

ai document fraud analysis

Flexible. Accurate. Affordable.

“The comprehensive information delivered by Fraud Finder significantly enhances our ability to scrutinise and evaluate the authenticity of bank statements, contributing to a more robust and accurate assessment process.”

Tamsin Elden, Director, Cubefunder

Fortify and automate your operations

Speed up review processes and onboarding with greater efficiency.

Reduce instances of spelling mistakes & missing data.

Automate time-draining tasks across thousands of documents.

Validate, assess and extract documents at scale globally.

Incorrect or timely data processing causes friction. Remove the hiccups.

Unlock more data-driven risk assessments and prevent fraud

We'll provide a short no-obligation demo of each element of our fraud tech, book below: